Unlock your

piece of the $391 billion US

point-of-sale financing market!

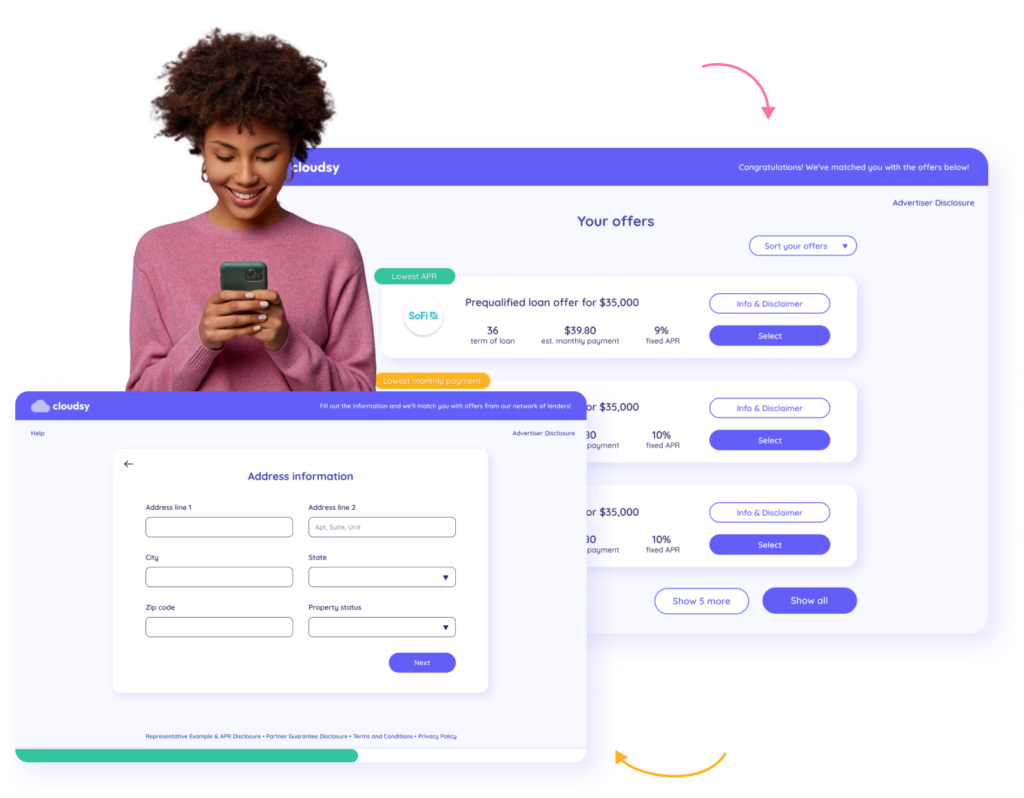

Unfamiliar with

point-of-sale financing?

It’s just another way to pay. Consumers complete a short, all-digital application and receive loan offers if they qualify. From there, they complete the transaction with their chosen lender and the proceeds are used to pay the merchant.

Multi-lender

platforms are the future

Enable streamlines the process by sourcing approvals from several lenders using a single, all-digital consumer application.

This eliminates your reliance on individual lenders and makes the application process quick and easy for the consumer.

Program Highlights

Every merchant qualifies

Access to 30+ lenders

Soft credit pull doesn’t affect credit

Terms up to

12 years

Loans up to $250,000

APRs as low

as 5.99%

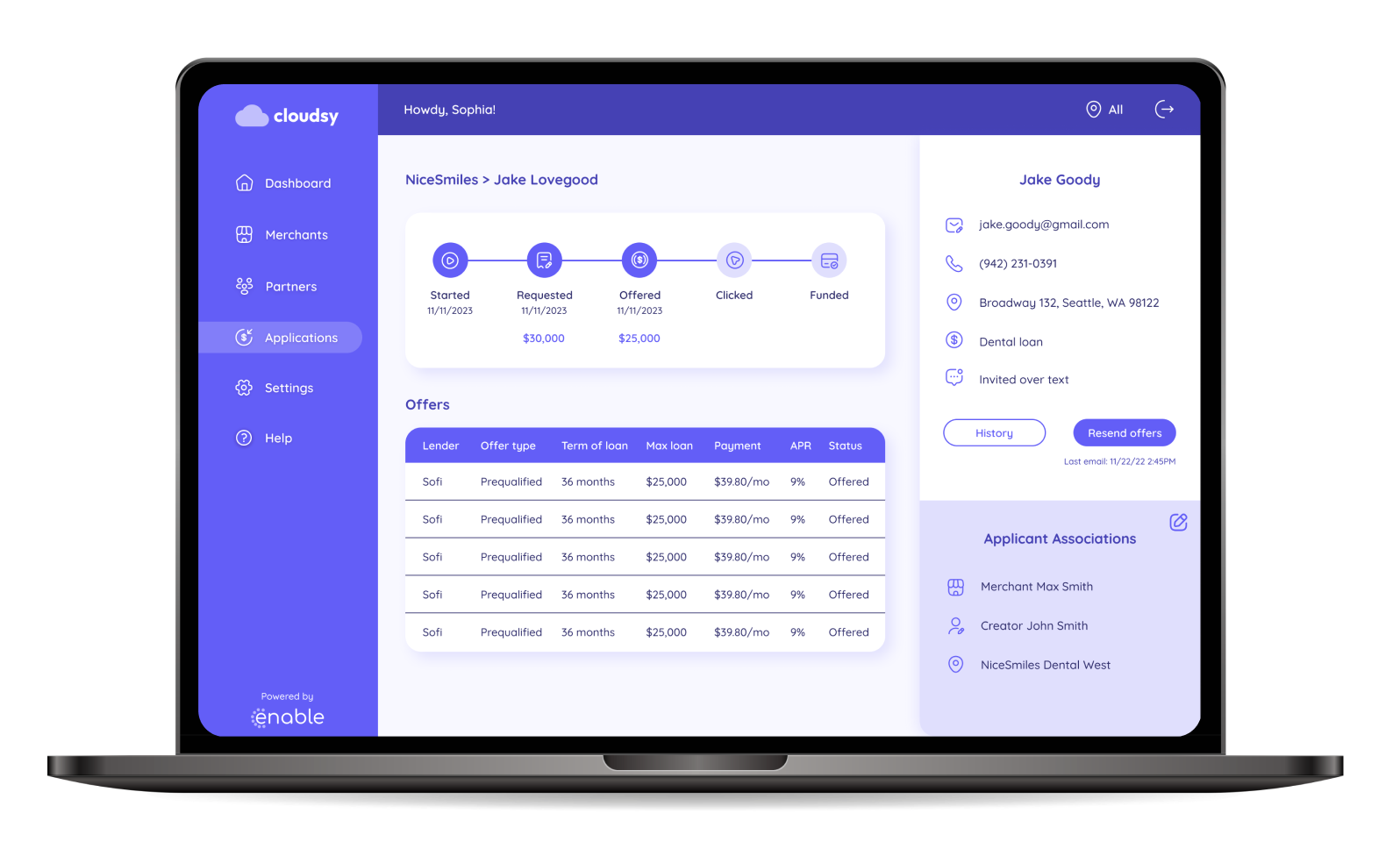

The Enable

technology platform

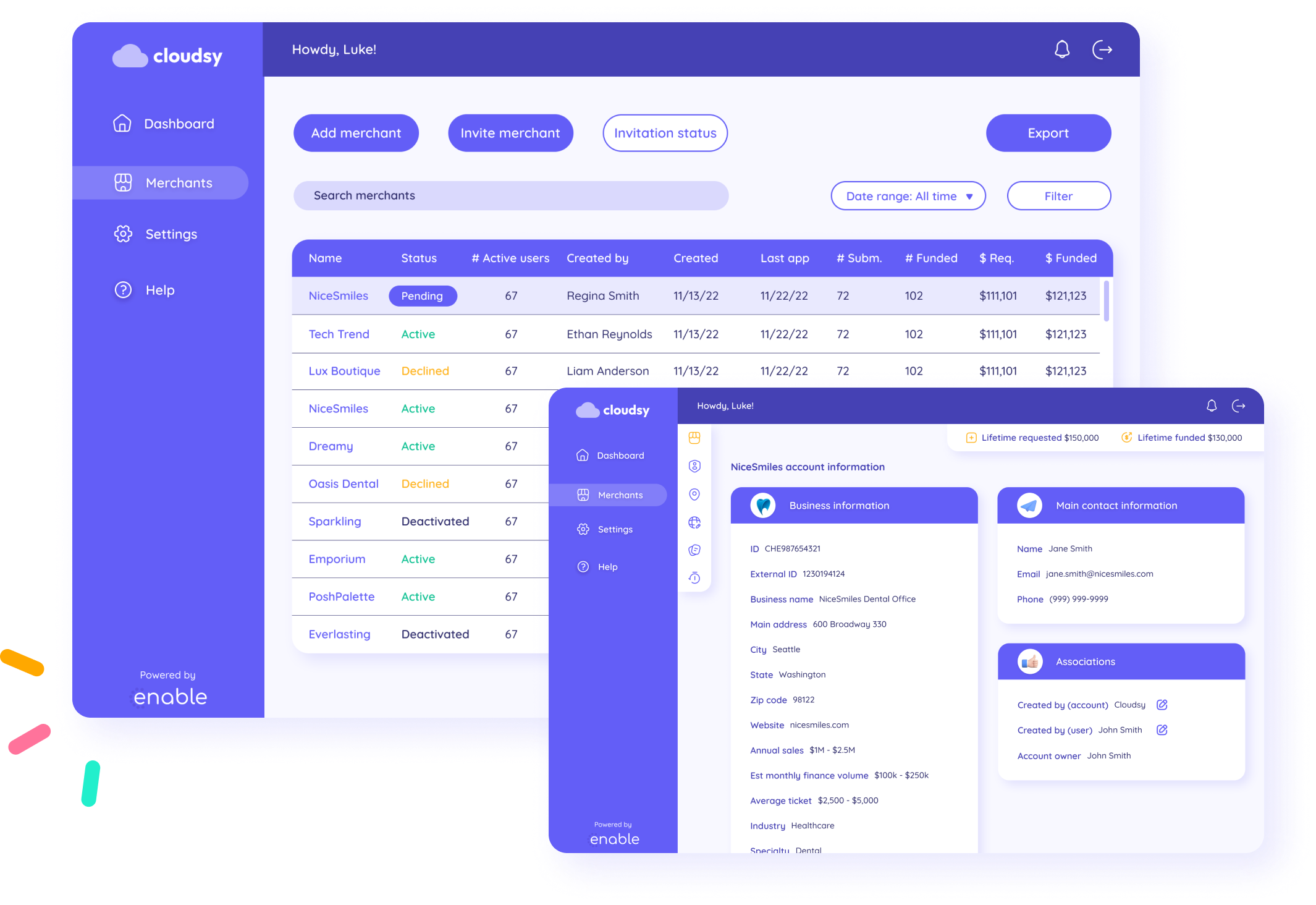

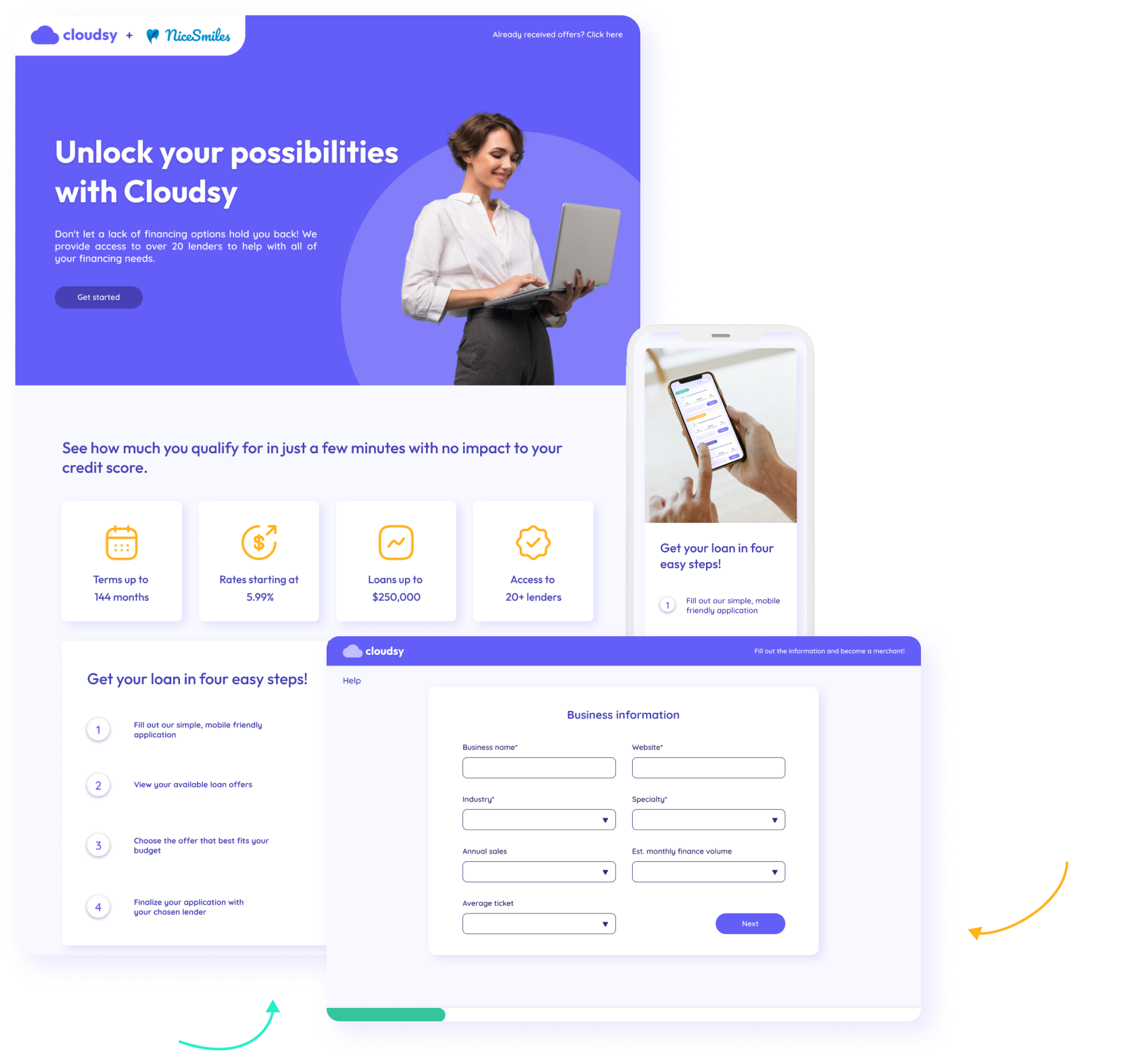

Your brand, your program

- Branded URL: yourbrand.lending.online

- Branded merchant onboarding experience

- Co-branded merchant landing pages (you and the merchant)

- Auto-deployed with each enrollment

Seamless integration

- Branded email notifications for your merchants, applicants and backoffice users

- Branded borrower application

- Branded backoffice portal

- Branded demo portal

What's in it for you

- Differentiate your business with a new, innovative product offering

- Improve customer retention with your new value-add

- Drive revenue growth through platform access, transaction fees and loan commissions

- Build even more customer loyalty as our product offering expands

- Invigorate your reseller network and attract new partners

Merchant benefits

- Increase sales by removing financial barriers

- Attract new customers

- Increase average ticket size

- Improve customer satisfaction

Consumer benefits

- Soft credit pull doesn’t affect their credit

- Break down large purchases into bite-sized payments

- Get an instant decision from 30+ lenders with one application

Platform Setup Fee

$30,000

$15,000

- Buildout of White-label platform

- Setup and approval of lender networks

- Creation of landing pages

- Buildout of demo platform

- Buildout of API center

- Personalized onboarding and training

- Branded promotional flyer

- Branded pitch deck

- Branded video tutorials

- Competitive intelligence

Platform Monthly Fee

Standard

$997/mo

- 0.35% Enable Funded Loan Fee

- 10% White-label Referral Commission (Net Rev)

- 40% (under $1M)

- 50% (over $1M)

- $2,500 Monthly Fee / Bucket of Merchants

- 200 of Merchants Included / Bucket

Premium

$2,997/mo

- 0.35% Enable Funded Loan Fee

- 20% White-label Referral Commission (Net Rev)

- 50% (under $1M)

- 60% (over $1M)

- $2,500 Monthly Fee / Bucket of Merchants

- 300 of Merchants Included / Bucket

Standard

$798/mo

- 0.35% Enable Funded Loan Fee

- 10% White-label Referral Commission (Net Rev)

- 40% (under $1M)

- 50% (over $1M)

- $2,500 Monthly Fee / Bucket of Merchants

- 200 of Merchants Included / Bucket

Premium

$2,398/mo

- 0.35% Enable Funded Loan Fee

- 20% White-label Referral Commission (Net Rev)

- 50% (under $1M)

- 60% (over $1M)

- $2,500 Monthly Fee / Bucket of Merchants

- 300 of Merchants Included / Bucket

What's Included

Standard

S

Premium

P

Technology Platform

White-labeled multi-lender POS financing platform

White-labeled borrower application and program landing page

White-labeled merchant onboarding and merchant landing pages

White-labeled back office portal

White-labeled email notifications

White-labeled partner portal and partner onboarding

White-labeled widget functionality and API center

Ongoing platform upgrades and support

Platform security and compliance

White-labeled advanced analytics

Removal of ‘Powered by Enable”

Lending Programs

DTC lending program enrollment

DTM lending program enrollment

B2B lending program enrollment

Want to earn even more commission?

Lock in our 10% commission boost to maximize your earnings!

For a limited time, we are allowing our white label partners to increase their commissions by 10% for only $1,500 a month.

Special Discounted Offer

SAVE even more by Paying UPFRONT

1 YEAR PAID UPFRONT

payment

standard

premium

setup fee

12 months of platform monthly fees

$15,000

$11,964

$15,000

$35,964

total value

$26,964

$50,964

special discounted offer

total savings over 1 year

savings

$20,000

$6,964

26%

$30,000

$20,964

41%

2 YEARS PAID UPFRONT

payment

standard

premium

setup fee

12 months of platform monthly fees

10% commission boost included

$15,000

$23,928

$36,000

$15,000

$71,928

$36,000

total value

$74,928

$122,928

special discounted offer

total savings over 1 year

savings

$25,000

$49,928

67%

$40,000

$82,928

67%

STARTER

FIXED

- Loan Commission Rev Share > 1m

- 45%

- Enable tech fee

- 0.45%

- Platform Monthly Fee

- $999

BASED ON YOUR DATA

- Total Top Line Loan Commission

- $20,000

- Total Enable tech fee

- $4,500

- Total Rev Commission Eligible

- $15,500

- Total Loan Commission

- $6,975

YOUR TOTAL PROFIT

$5,976

PREMIUM

FIXED

- Loan Commission Rev Share > 1m

- 60%

- Enable tech fee

- 0.35%

- Platform Monthly Fee

- $1,999

BASED ON YOUR DATA

- Total Top Line Loan Commission

- $20,000

- Total Enable tech fee

- $3,500

- Total Rev Commission Eligible

- $16,500

- Total Loan Commission

- $9,900

YOUR TOTAL PROFIT

$7,901

ENTERPRISE

FIXED

- Loan Commission Rev Share > 1m

- 75%

- Enable tech fee

- 0.25%

- Platform Monthly Fee

- $2,999

BASED ON YOUR DATA

- Total Top Line Loan Commission

- $20,000

- Total Enable tech fee

- $2,500

- Total Rev Commission Eligible

- $17,500

- Total Loan Commission

- $13,125

YOUR TOTAL PROFIT

$10,126

CALCULATION BREAK DOWN

FIXED

- Platform Monthly Fee

- $2,999

- Enable platform usage fee.

- Loan Commission Rev Share > 1m

- 75%

- Percentage of your loan commission share with over 1 million funded volume.

- Enable tech fee

- 0.25%

- Percentage of Enable tech fee.

BASED ON YOUR DATA

- Your total funded volume

- $1,000,000

- Your total funded monthly amount.

- Assumed loan commission

- 2%

- Average commission percentage paid to Enable from lenders.

- Total Top Line Loan Commission

- $20,000

- Commissions amount according to the funded volume.

- 2% of $1,000,000 = $20,000

- Total Enable tech fee

- $2,500

- Enable tech fee amount according to the funded volume.

- 0.45% of $1,000,000 = $4,500

- Total Rev Commission Eligible

- $17,500

- Enable tech fee amount removed from top line loan commissions.

- $20,000 - $4,500 = $15,500

- Total Loan Commission

- $13,125

- Your monthly loan commission revenue share.

- 45% of $15,500 = $6,975

- Total Profit

- $5,976

- Your total monthly profit after the monthly fee is paid.

- $6,975 - $999 = $5,976

In only 90 days, Coach Financing used the Enable platform to generate:

#255

Merchants enrolled

$126,255

Sign-up revenue

$13,563

Subscription revenue

$26,650

In loan commissions

The Enable Financing platform has revolutionized our business. The ease of use and ability to invite merchants so easily is a game changer for us saving us an incredible amount of time and money. The robust reporting system, frontend dashboard are all leading interfaces.

The whole system has helped us not only with current sales but also retention. Having a system that can waterfall applications and includes multiple lending programs makes this the Rolls Royce of Financing platforms.

Why Enable?

The only company in point-of-sale financing that exclusively focuses on reseller success.

The only comprehensive reseller offering including technology, sales, support, marketing and strategy consulting.

An experienced team of point-of-sale financing experts who have built multiple Fintech companies and resold over 2 dozen lending programs.

Ongoing support

- All resellers are provided with setup and training on the technology platform to ensure a seamless rollout

- Ongoing business reviews with our account management team will ensure you maximize your potential

- Enable can optionally provide white-labeled merchant sales and support so you don’t need to hire and manage your own team

- Level 2 customer support is provided free of charge

The time to lock in your contract is now

Our prices are heavily discounted for a short-time and will increase with each major release. If you want to lock in the lowest pricing and best deal we’ll ever offer, the time is now.

Starter package

Premium package

Enterprise package

Ready to launch your own branded finance platform?

Book a one-on-one meeting with one of our experts to learn how Enable can help you build a profitable point-of-sale lending business without building any of the technology or lender integrations yourself. Upon successfully completing the form below, you’ll gain access to our online calendly booking system where you can schedule time to meet with one of our consultants.

2023 All Rights Reserved. Privacy Policy | Terms