WATCH OUR WEBINAR NOW

Within 6 months of launching with Enable, Coach Financing generated $332K in revenue. How?

We’ll deep dive on the exact roadmap Coach Financing used to generate this revenue and discuss their strategies for how they use the Enable platform to generate multiple streams of revenue. We’ll even discuss some of the challenges they’ve faced along the way and why they’re forecasting massive growth in 2024 with Enable.

If you’re in payments, point-of-sale financing (BNPL) can make you a lot of money. It’s quickly becoming the next frontier for ISOs and payment professionals alike.

Watch this webinar and learn how.

On this webinar you’ll learn:

- How CF generated 332K in 6 months

- CF’s exact roadmap to success

- CF’s challenges and how they overcame

- CF’s growth plans for 2024

- How CF partners with Enable

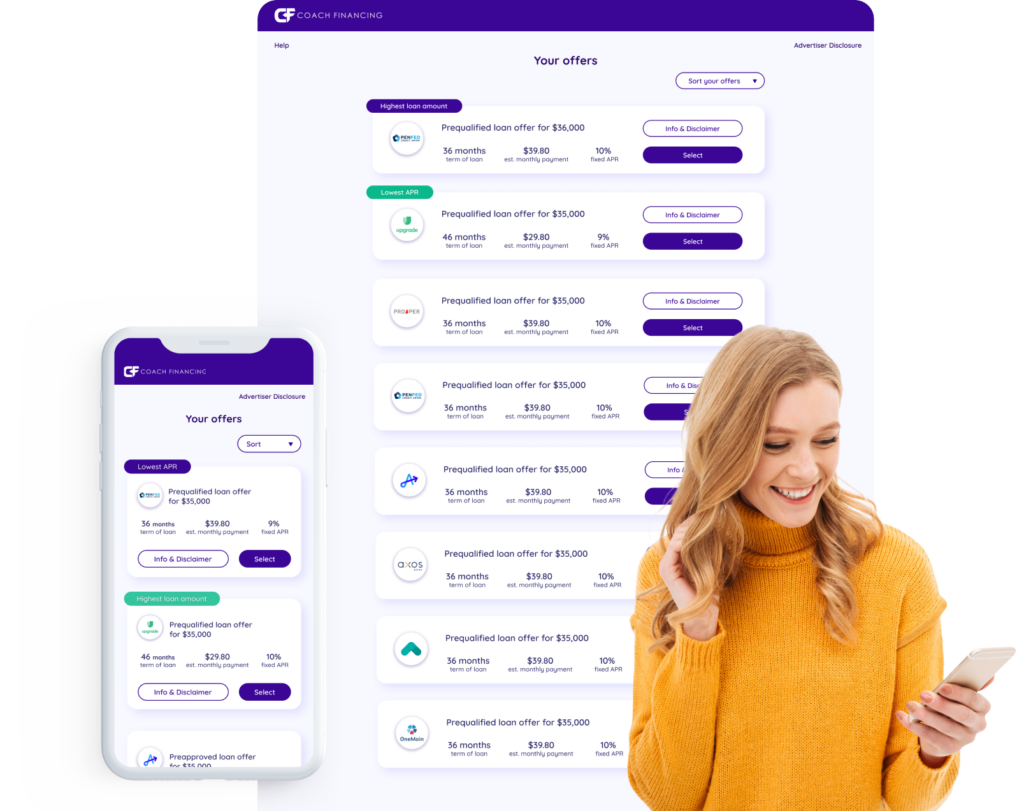

- How the Enable white-label platform works

SPEAKERS

ABOUT ENABLE

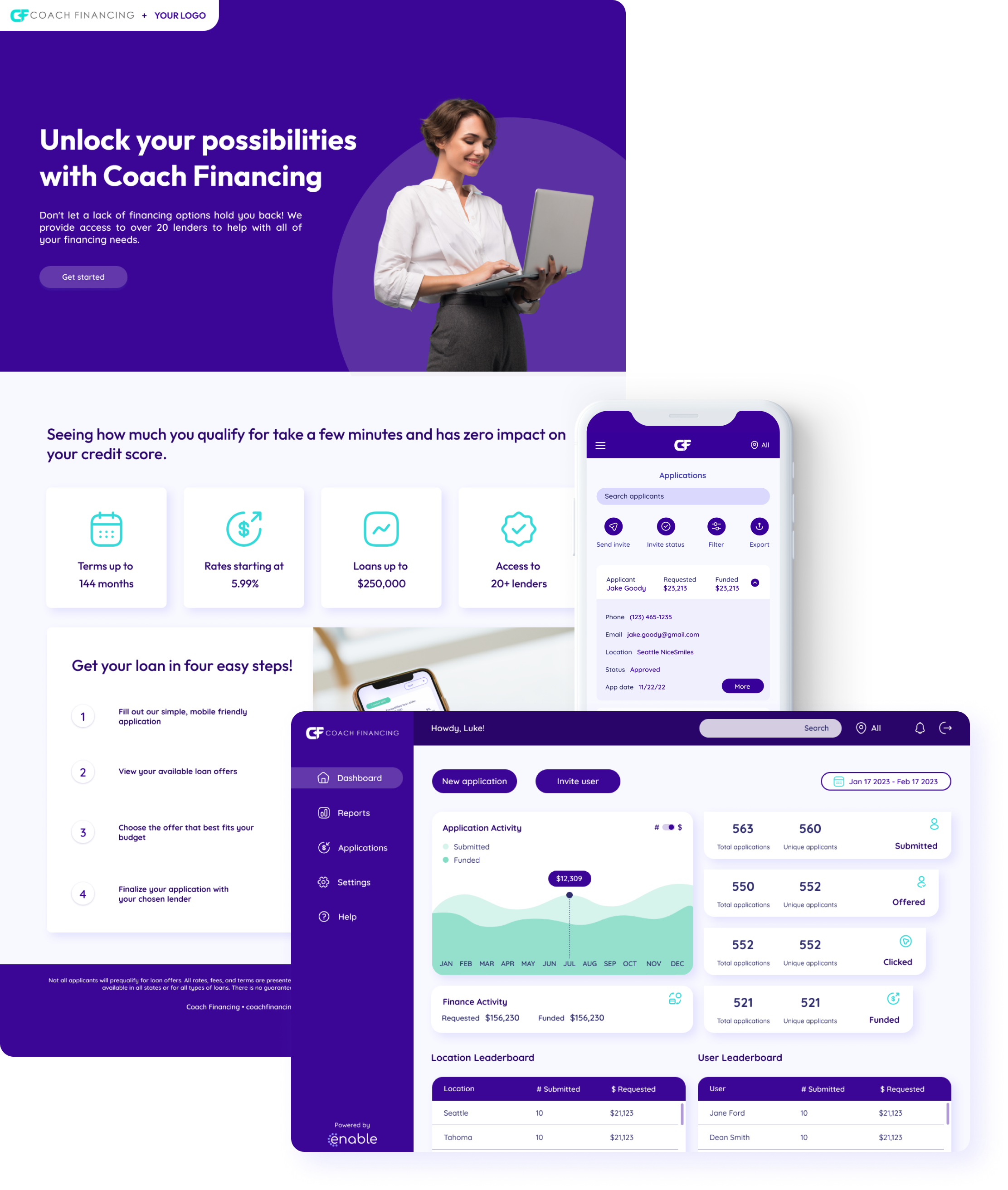

At Enable, our mission is to democratize access to point-of-sale lending. Whether that be for lenders, borrowers, merchants or partners, our mission is to provide access to point-of-sale financing in new and thoughtful ways. By integrating multiple lenders into one streamlined application, Enable empowers merchants to confidently offer financing to their customers when they need help closing a high-ticket purchase.

Built from the ground up to be white-labeled, Enable’s technology can be branded as your own without any of the heavy lifting. We integrate the lenders, build the technology, develop the APIs and handle all security and compliance. You brand the platform as your own and launch a new profit center in days. But Enable is more than just technology, we’re the only company in point-of-sale lending that exclusively focuses on reseller success and the only comprehensive reseller offering including technology, sales, support, marketing and strategy consulting.

ABOUT COACH FINANCING

Coach Financing was started with a single purpose in mind: To help solve real problems that coaches and consultants face when it comes to expanding their reach and enrolling new clients. Affordability is the #1 reason customers don’t move forward with high-ticket coaching offers. Seeing an opportunity, Coach Financing was created to help coaches, consultants, and online course creators offer financing to their customers and close the gap on affordability, helping to enroll more clients.

The Coach Financing team has over 35 years of experience in the finance and payments industry and has processed over $2B in loans since 2020. Prior to partnering with Enable, Coach Financing partnered with multiple other companies in point-of-sale lending, in search of the white-labeled solution eventually found in Enable.