The Surge of BNPL: Meeting Consumer Expectations in the Economy of Now

As the demand for convenience and instant gratification reshapes consumer behavior, Buy Now, Pay Later (BNPL) is emerging as a cornerstone of the modern shopping experience. This payment model allows consumers to make purchases and pay for them over time, empowering merchants to meet the rising expectations of today’s #NOW economy.

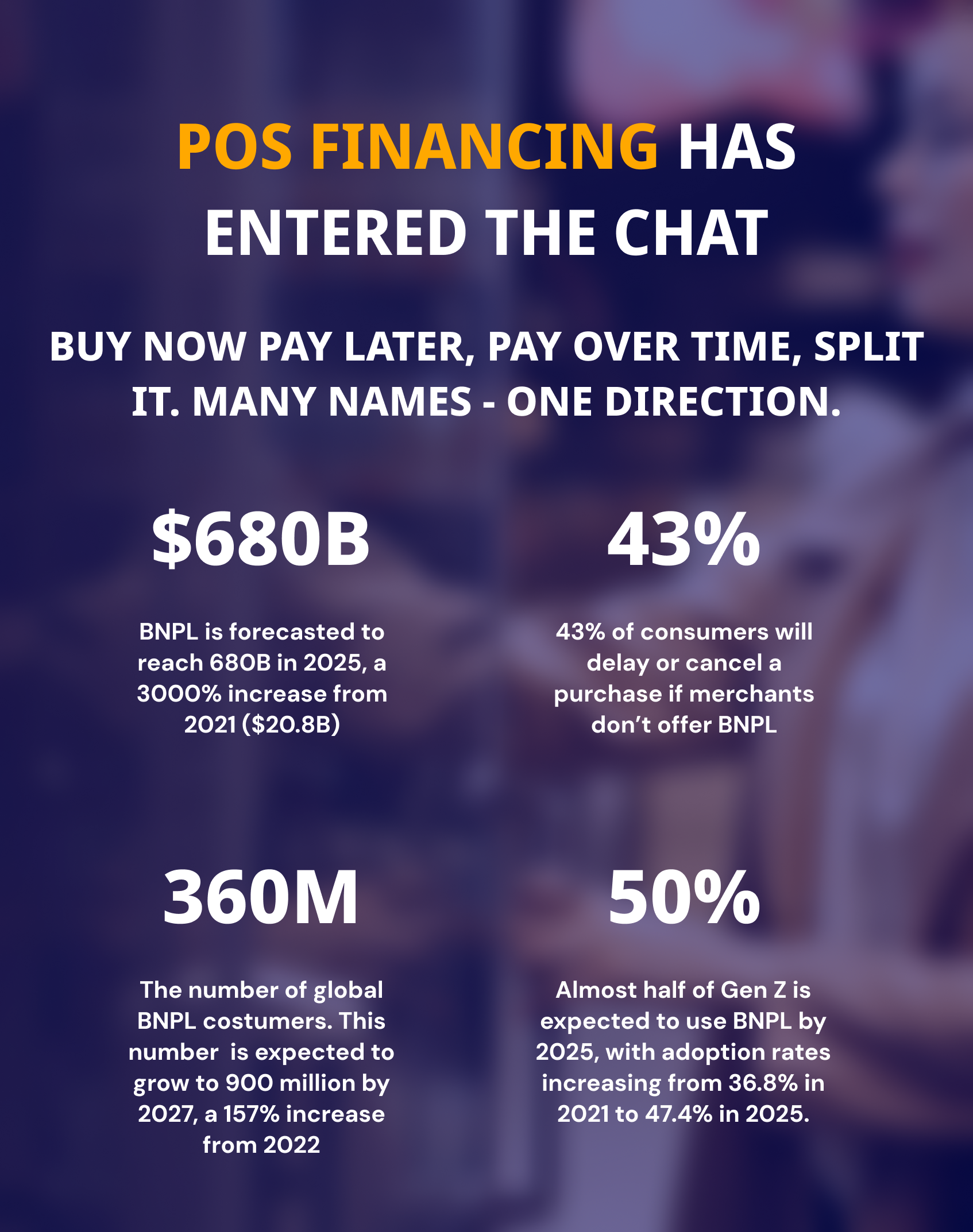

The Rise of BNPL: A Data-Driven Perspective

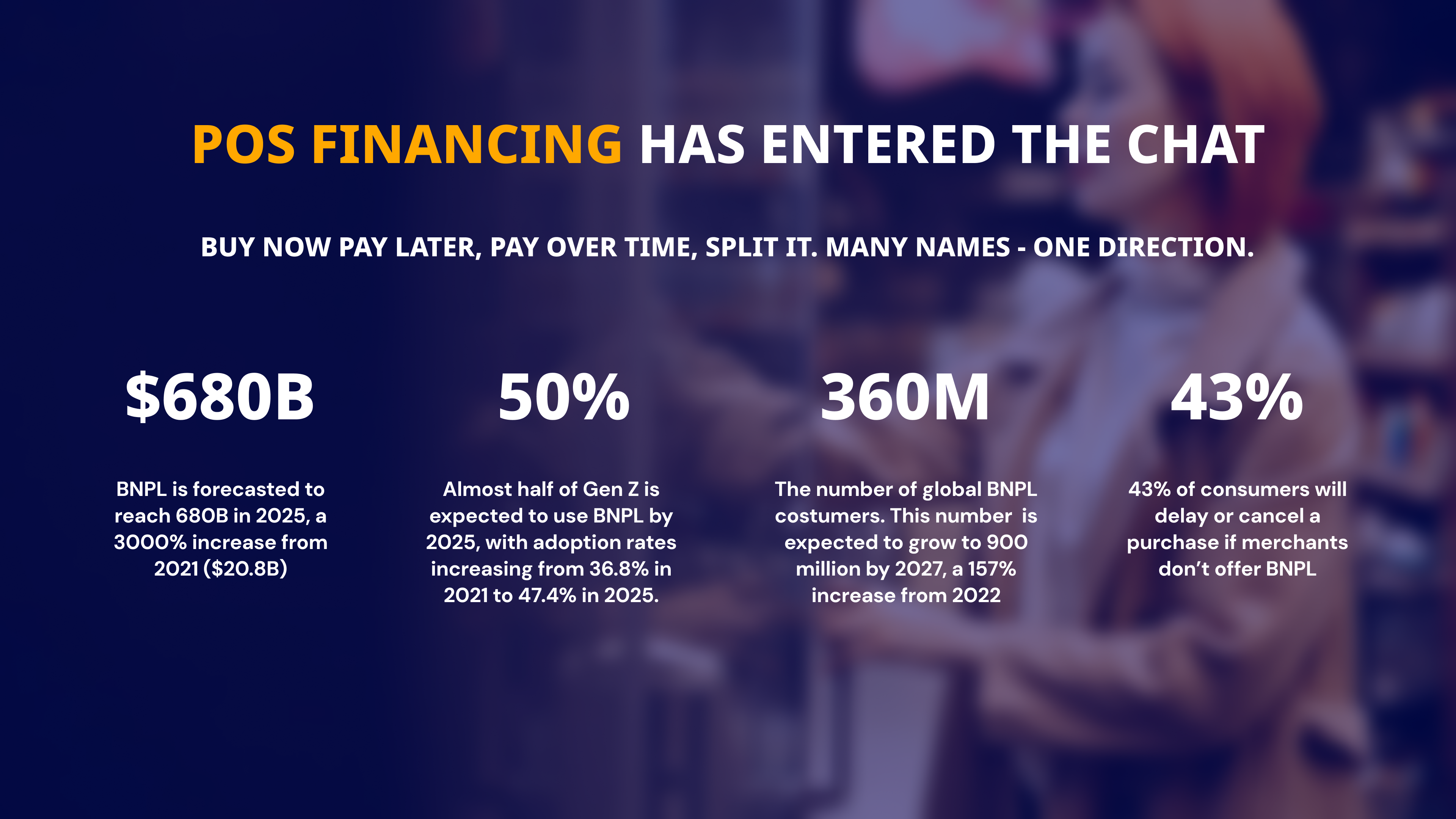

- Adoption Across Demographics: 50% of consumers aged 25-44 have used BNPL, reflecting a generational shift toward financial flexibility. By contrast, only 19% of those aged 55+ have embraced it, underscoring its appeal to younger, tech-savvy audiences.

- Explosive Market Growth: The global BNPL market has seen exponential growth, expanding from $20.8 billion in 2021 to a projected $680 billion by 2025—a staggering increase of over 3,000%.

- Consumer Preferences: Studies show that 43% of consumers will delay or cancel a purchase if BNPL is not offered. Additionally, BNPL increases average order values by 40% to 85%, demonstrating its capacity to drive revenue for merchants.

Drivers of Adoption: Convenience Meets Necessity

A recent study by PYMNTS highlights a critical reason for BNPL’s rise: 70% of users turn to BNPL to address cash flow shortages. For these consumers, BNPL offers an essential bridge, enabling them to make necessary purchases without immediate financial strain. This shift underscores BNPL’s growing role as a budgeting tool and financial enabler.

BNPL’s Role in Holiday Spending

The holiday season amplifies the significance of BNPL services:

- Increased Usage: Approximately 29% of shoppers plan to use BNPL tools during the holiday season, up from 24% in 2023.

- Marketing Leverage: Retailers are actively promoting BNPL options as part of their holiday marketing strategies, offering 0% financing plans to attract value-conscious consumers. This approach not only enhances customer acquisition but also encourages higher spending without deep discounting.

The Merchant Mandate: Compete or Miss Out

For businesses, offering BNPL is no longer optional—it’s a competitive imperative. Here’s why:

- Higher Order Values: Merchants leveraging BNPL often experience increased cart sizes and additional purchases.

- Reduced Cart Abandonment: Flexible payment options alleviate sticker shock, leading to fewer abandoned carts.

3. Enhanced Competitiveness: Businesses that embrace BNPL attract younger demographics and tech-forward consumers, building loyalty and driving growth.

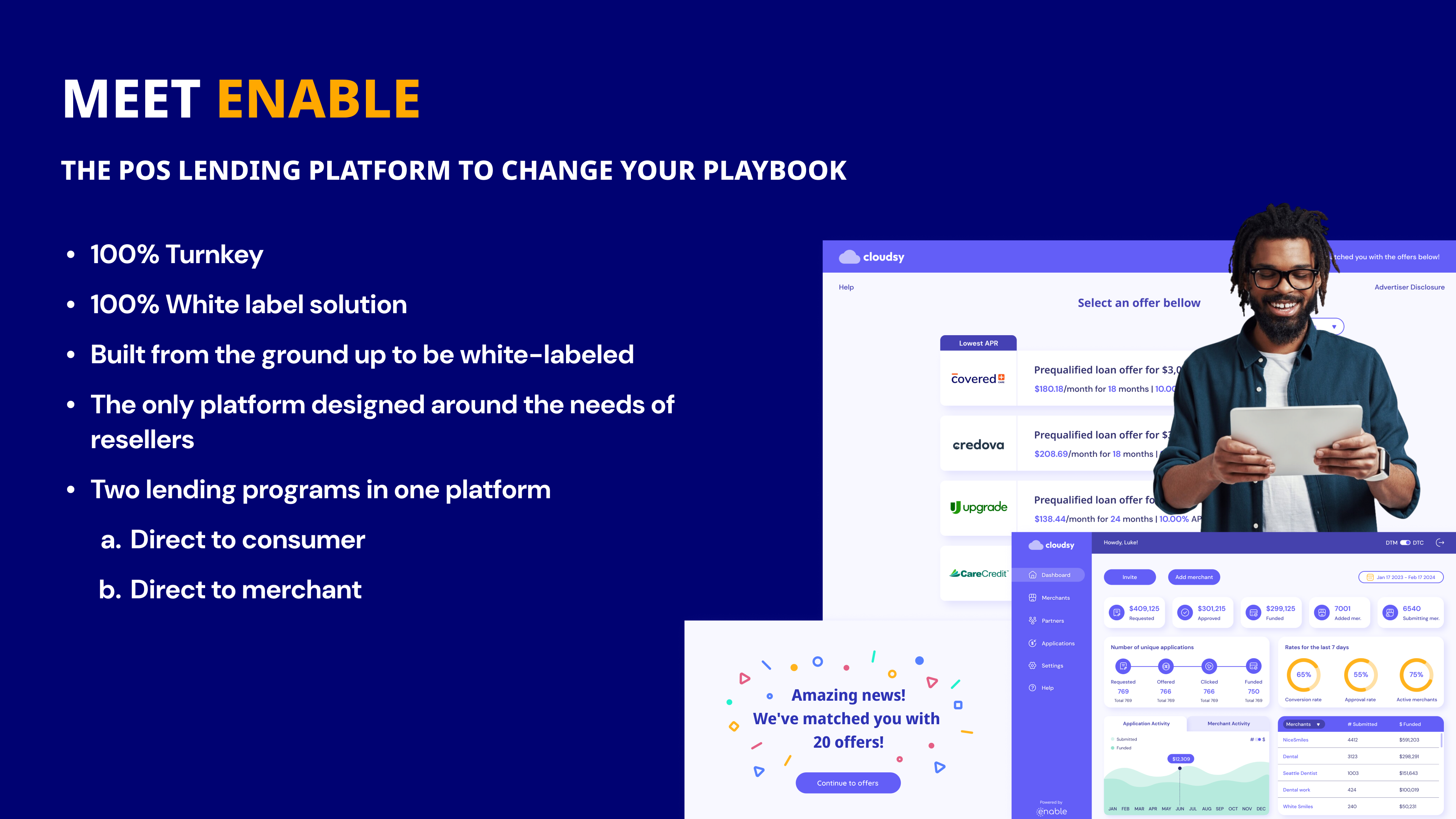

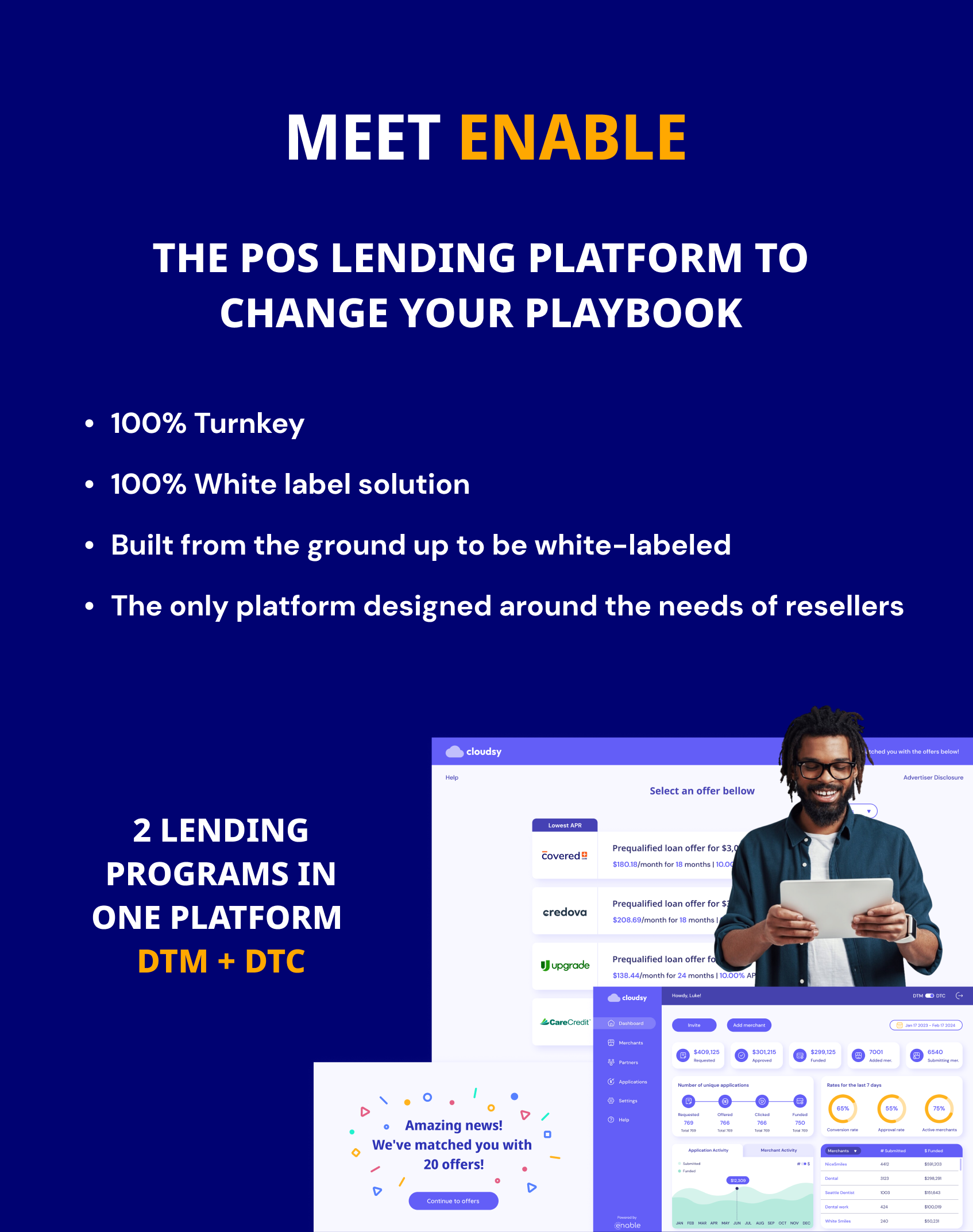

Enable Financing: Empowering Merchants and Resellers

Enable Financing, a turnkey white-label platform, is purpose-built to help merchants and resellers succeed in the BNPL economy. By seamlessly integrating POS financing, Enable equips partners to:

- Drive Revenue: Create new income streams through activated loans.

- Enhance Brand Value: Offer a fully branded financing experience.

- Deliver Flexibility: Provide tailored payment solutions, meeting diverse consumer needs.

With best in class technology and strategic integration into a robust network of top lenders, Enable ensures businesses stay competitive in a rapidly evolving landscape.

Looking Ahead: The Future of BNPL

The convergence of technology and consumer expectations is set to propel BNPL further into mainstream adoption. By 2027, the global BNPL customer base is expected to reach 900 million, solidifying its place as a transformative force in retail.

For businesses ready to adapt, the opportunity is clear. BNPL is not just a payment option—it’s the new standard for customer satisfaction and growth.

Ready to embrace the BNPL revolution? Explore how Enable Financing can position your business for success in the #economyofnow.

Enable, Inc

25132 Oakhurst Dr Suite 206

Spring, TX 77386

P: +1 (888)-801-1736

E: sales@enablefinancing.com

2023 Enable, Inc. All Rights Reserved. Privacy Policy | Terms